single life annuity vs lump sum

The main difference between a lump-sum and a monthly payment is that with a lump-sum option you get to have control over how your money is invested and what happens to it once youre gone. If thats the case then the lump-sum option is your best bet.

Strategies To Maximize Pension Vs Lump Sum Decisions

This annuity is usually purchased by married couples and can provide income for two people with payment based on the lives of both the owner and spouse who is the joint annuitant.

. Tata AIA Life Insurance Smart Annuity Plan. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. The IRS has rules for.

Depending on the contract other events such as terminal illness or critical illness can also trigger payment. A single premium immediate annuity SPIA is one of the simplest types of annuity contracts. Neither New York Life Insurance Company nor its.

However choosing a pension annuity and not deferring Social Security is not advisable. With a SPIA you make a single large deposit with an annuity company and your monthly payments begin. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policyholder.

An individually owned nonqualified single-premium deferred fixed annuity. As you might expect annuity payments that continue for the duration of two lives are going to be less than those that are for a single life. Microsoft describes the CMAs concerns as misplaced and says that.

Accidental death etc with a lump sum amount or income for a fixed period. Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts. Save Tax Up to Rs 46800 Save Tax Up to Rs 46800 When you buy a term insurance plan you can avail tax benefits as per the applicable Income tax laws.

Choose from pensions that are for a single life Joint and survivor or a life with 10 years certain. Pension annuity almost always provides a higher annual amount versus what you would receive if you purchased a retail annuity with the lump sum. When a CD reaches its maturity you can take the CDs lump-sum value in cash renew the CD for the same or for a different maturity period or examine other savings alternatives such as a fixed deferred annuity.

A lump-sum payment is usually taken in lieu of recurring. A lump-sum payment is a one-time payment for the value of an asset such as an annuity or another retirement vehicle. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

In most cases the lump-sum option is clearly the way to go. Tata AIA Life Insurance Guaranteed Monthly Income Plan.

Taking A Lump Sum Vs Annuity From A Pension Which One Is Better

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Investing A Lump Sum Vs An Annuity Charles Schwab

Investing A Lump Sum Vs An Annuity Charles Schwab

Lump Sum Vs Annuity Which Should You Take Smartasset

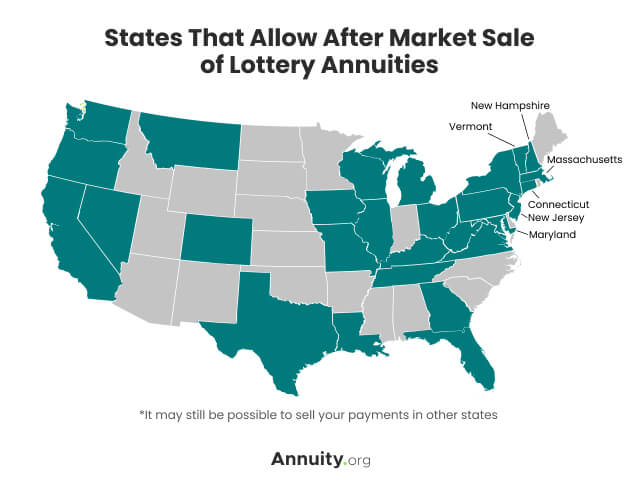

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Lottery Payout Options Annuity Vs Lump Sum

When Can You Cash Out An Annuity Getting Money From An Annuity

What Is A Lump Sum Payment And How Does It Work

Taking A Lump Sum Vs Annuity From A Pension Which One Is Better

Annuity Payout Options Immediate Vs Deferred Annuities

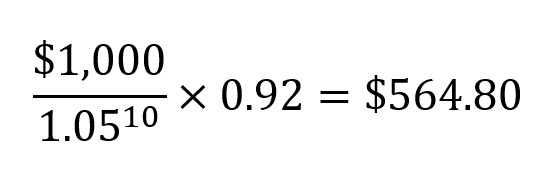

The Anatomy Of A Lump Sum Conversion

What Is The Mega Millions Annuity Vs Lump Sum As Usa

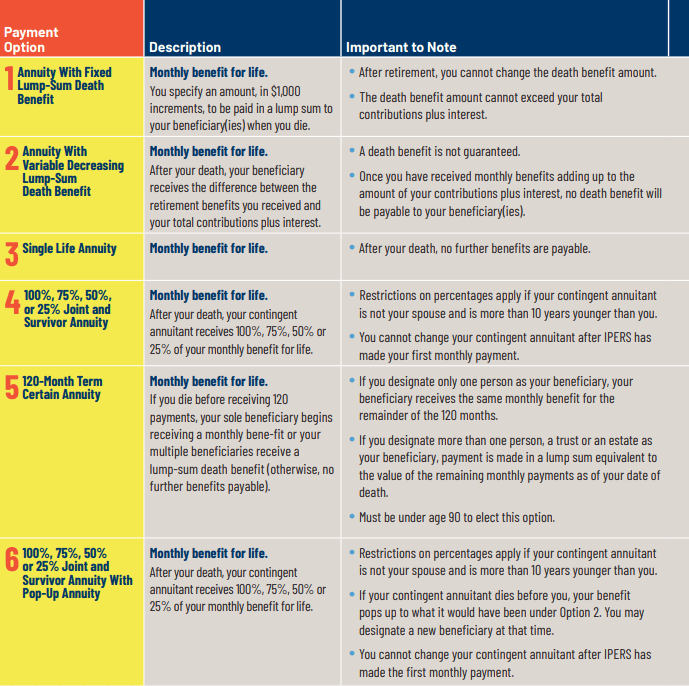

Ipers Retirement Options What Are The Best Ipers Payout Options For You

Spia Single Premium Immediate Annuity Forbes Advisor

Annuity Vs Lump Sum What S The Right Choice

Annuity Payout Options Immediate Vs Deferred Annuities

An Investigation Of Time Preferences Life Expectancy And Annuity Versus Lump Sum Choices Can Smoking Harm Long Term Saving Decisions Sciencedirect

Difference Between Annuity And Lump Sum Payment Infographics